About Medicare & Medicare Supplement Insurance

Medicare is a federal program that provides assisted health benefits for people at retirement age (currently 65 years and older), people with disabilities, ALS, and end-stage renal disease. Medicare typically covers 20% of medical bills, but there are deductibles and coinsurance that Medicare does not cover at all, or hospital costs that increase according to the length of time a person is in the hospital or rehabilitation center.1

Medicare Supplement insurance was created by private health insurance companies to cover some of the out-of-pocket costs not paid by Medicare. Medicare Supplement insurance covers costs with some of the deductibles, co-payments, and coinsurance related to Medicare approved hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges.

Medicare Supplement insurance is also known as “Medigap” Insurance because it fills in some of the ‘gaps’ of what Medicare Part A and B do not cover.

Medicare has changed and developed over the years. The need for supplemental insurance has always been there. United American Insurance was one of the first insurers to establish Medicare Supplement, shortly after Medicare became law.

All Medicare Supplement is regulated at the state level by state Insurance Departments. Plans and coverages for Medicare Supplement are standardized benefit offerings across the board for all insurers.

This guide will explain the many variations of coverage with Medicare Supplement insurance.

Types of Medicare Supplement Plans

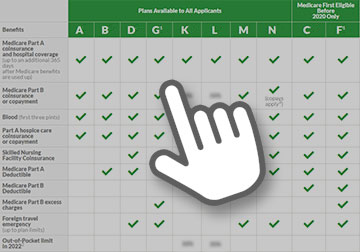

As of 2023, Medicare Supplement insurance has 10 variations of plans labeled A, B, C, D, F, G, K, L, M, and N. Each plan has different standardized benefits giving the consumer many choices of how much supplemental insurance they need and what is covered.

View the graph at our Medicare Supplements page to understand how the different plans work.

NOTES:

- Plans F & G also have a high deductible option which require paying a policy deductible before the policy begins to pay. Once the policy deductible is met, the plan pays 100% of covered services for the rest of the calendar year.

- Plan C & F are not eligible for anyone who is new to Medicare on or after January 1, 2020.

- Plan K & Plan L show how much they'll pay for approved services before you meet your out-of-pocket yearly limit and Part B deductible. After you meet these amounts, the policy will pay 100% of your costs for approved services.

- Plan N pays 100% of the costs of Part B services, except for copays for some office visits and some emergency room visits.

- If you live in Massachusetts, Minnesota, or Wisconsin, your state offers different standardized plans.

Medicare Supplement Enrollment

A six-month open enrollment for Medicare Supplement insurance occurs when a person is both 65 years of age and is enrolled for benefits under Medicare Part B. Some states also require a six-month open enrollment for those under age 65 and enrolled in Medicare due to a disability. Besides open enrollment there are other events, such as a loss of health insurance under your employer’s coverage, which may happen at any time of year, and would make you eligible to enroll outside of the normal enrollment period. Below is a list of different life events that make a person eligible to apply for a Medicare Supplement insurance policy.

-

You selected Medicare Advantage during your first year of enrollment, but you want to switch back to Original Medicare and apply for a Medicare Supplement insurance policy.

-

You are enrolled in a Medicare Advantage Plan and move out of the MA service area and want to enroll in Original Medicare and apply for a Medicare Supplement insurance policy.

Medicare Advantage enrollees have two annual opportunities to switch back to Original Medicare and apply for a Medicare Supplement insurance policy. The first is the Medicare Advantage Open Enrollment Period from January 1 through March 31, and the second is the Annual Election Period from October 15 through December 7.

All insurance companies that offer other health plans do not have to offer Medicare Supplement. If an insurance company does offer Medicare Supplement, there are two requirements for an insurance to be able to offer.

Medicare supplement insurance:

- If they offer any Medicare supplement plan, they must offer Plan A.

- They also must offer Plan D or Plan G if they offer any Medicare Supplement insurance plan.

Some Services Not Covered by Medicare Supplement Insurance

- Prescription drugs

- Vision care (except for specific eye diseases and risks)

- Eyeglasses or contacts

- Dental care

- Hearing aids

Prescription drug coverage is not included in Medicare Supplement, but is provided by other private insurance companies.

Want to learn more about Medicare Supplement Insurance?

See the options available.

Restrictions and Requirements for Purchasing Medicare Supplement Insurance:

- You must be enrolled both Medicare A & B for the life of the Medicare Supplement insurance.

- You cannot use Medicare Supplemental Insurance for Medicare Advantage co-pays. The two cannot be held simultaneously.

- Medicare Supplement insurance cannot be issued to a person receiving Medicaid Benefits.

Other sources are: