What is the best Medicare Supplement plan to enroll in for 2023?

With 10 Medicare Supplement insurance plans to choose from, it can be confusing to know which one is best for you. You want to choose a plan that meets your health needs and fits your budget.

Medicare doesn’t pay all your costs. Understanding the out-of-pocket costs for each of these can help you decide what additional coverage you may need and want.

Each year, the Centers for Medicare and Medicaid Services (CMS) releases updated Medicare Part A and B, cost-sharing, which consists of the deductibles, coinsurance, and copays you pay for Medicare services.

For 2023, Medicare beneficiaries will pay:1

- Medicare Part A Deductible: The inpatient hospital deductible when admitted to a hospital is $1,600, which is an increase of $44 from $1,556 in 2022.

- After the Medicare Part A deductible is met, Medicare Part A covers hospital inpatient care for 60 days. On the 61st day, the coinsurance a beneficiary pays is $400 per day. When 90 days are reached, another 60 lifetime reserve days can be used with coinsurance at $800 a day.2

- Medicare Part A covers 20 days in a skilled nursing facility for extended care in a benefit period. For days 21 through 100, the coinsurance is $200 a day.

- Medicare Part B Monthly premium: $164.90, which is a decrease from 2022 by $5.20 per month.

- Medicare Part B Deductible: The annual deductible is $226.00, which is a decrease from 2022 by $7 per month.

- Medicare Part B: after the deductible of $226 is paid, there are still out of pocket costs such as coinsurance of 20%.

- Medicare Part D. Depending on the type of prescription drug coverage you choose and your annual income, the monthly insurance premium amount can vary.3

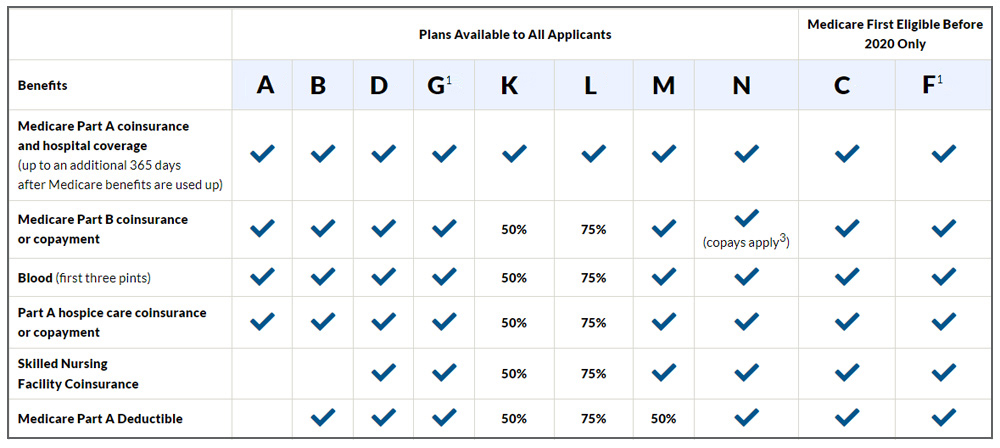

Please refer to the table on our Featured Product page (Medicare Supplement Insurance) for a brief comparison of the 10 Medicare Supplement insurance plans available for 2023. The table illustrates the benefits available under each plan and the relation to Original Medicare. You must be enrolled in Original Medicare Part A or Part B or both to be eligible for supplemental insurance.4

Note: On the left-hand side, the column shows the benefits of each plan in relation to what Medicare provides. Across the top of the table are plans labeled A, B, D, G, K, L, M, N, C, and F. Refer to the Featured Product page for updated information.

To know which Medicare Supplement insurance plan works best for you, and to determine how much coverage you need to fill some of the gaps in Medicare Parts A and B, the following questions may help define what you need:

- How is your health status? Do you go to the doctor regularly or need regular medical attention?

- Do you travel frequently, domestically, and internationally?

- Are you looking only for basic coverage?

- Are you on a group plan with an employer or union, or on your spouse’s plan?

- What is your budget for additional Medicare Supplement insurance?

- Do you prefer a high deductible each year or everything covered at a higher premium rate on a monthly basis?

Research Medicare Supplement policies that may fit your insurance needs.

Here is more information that may help you pick a policy.

Let's highlight how these plans might answer the questions above:

Full coverage is F and G

If you are looking for the plan with the highest level of supplemental coverage, Plan F is the most comprehensive. Only those who were Medicare eligible before January 1, 2020, can participate in this plan. An alternative is Plan G, which is exactly like Plan F except for one benefit. The Medicare Part B deductible each year is not included. You are responsible for paying the annual deductible.

If you travel frequently

Plans D, G, M, N, C, and F cover foreign travel with plan limits. Plan limits are specific to the Medicare Supplement policy you sign up with. Medical Supplement plans usually cover expenses for domestic travel.

I just want the basics

You may have additional funds for medical emergencies or healthcare beyond Medicare. Or you may have an excellent health history and want the basic gap coverage. Plan A and B cover an additional 365 days beyond what Medicare Part A pays in hospitalization. Both plans pay coinsurance for Medicare Part A and Medicare Part B.

Out of pocket limits

If exceeding out of pocket limits is important to you, Plans K and L cover all expenses 100% after the out-of-pocket limit. For 2023, Plan K is $6,620, and for Plan L, the 2023 out-of-pocket limit is $3,310.

High Deductible

If you want coverage for a majority of medical expenses, but you don’t want to pay a higher premium for such coverage, Plans F and G have high-deductible enrollment. A high deductible reduces the monthly premium. Each year, you must satisfy the deductible before the plan covers the additional out-of-pocket medical expenses not covered by Original Medicare. For 2023, the deductible is $2700. And remember, Plan F is only for those who are eligible for Medicare before January 1, 2020.

Why is Plan C and Plan F on this table?

Plan C has the same date limitations as Plan F. A Medicare beneficiary is only eligible for Plan C if he/she turned 65 before January 1, 2020. The reason these two plans are shown is because eligible Medicare beneficiaries, who have not enrolled, still have the opportunity to do so while this plan is made available.

This year is a great year to choose a plan that benefits you in the long run. Talk with an insurance agent who sells Medicare Supplement insurance. They understand Medicare Supplement insurance plans and can assist you in choosing a plan that works for you.

Sources:

- https://www.medicare.gov/basics/get-started-with-medicare/medicare-basics/what-does-medicare-cost

- https://www.medicareinteractive.org/get-answers/medicare-covered-services/inpatient-hospital-services/lifetime-reserve-days

- https://www.tdi.texas.gov/consumer/hicap/medicarepartd.html

- https://www.medicare.gov/medigap-supplemental-insurance-plans/#/m/plans?fips=48113&zip=75204&year=2023&lang=en

Other Sources: